The Sales Economy: What’s Coming (from people smarter than me), and a Counterintuitive Way To Thrive

A sales nerd and two well-known CNBC economists walk into a room.

This isn’t a joke – this happened to me last week. Long story, but the short version is that I watched a taping of a segment where two CNBC analysts were talking about the near-term economy. After listening to their discussion, we walked out of the studio together and they asked me what I thought.

“Other than wanting to go cry myself to sleep, this was so interesting. But I’m left with so many questions”

“Oh really. Like what?”

You see, the core of the discussion they had was around their mutual opinion that the economy isn’t about to get better…it’s about to get worse. Interest rates were raised pretty dramatically to squash inflation. Historically, that should work in the near term, but it has a long-term cost. Their opinion was it’s political – squash inflation before the election, claim it as a win, but rising interest rates dramatically slow investment and growth. In other words, inflation will slow, but soon after, the economy will slow down even more. Add to it the issues happening overseas in Europe, the threat of a currency crisis, and we have a recipe for a deep recession.

With my sales history + modern sales brain fully engaged, I wanted to figure out what was next.

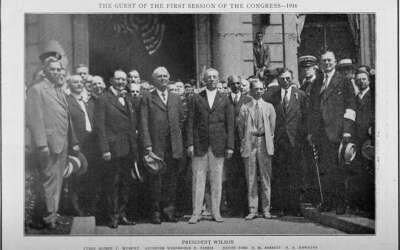

I first explained that we’ve seen this story before. History is repeating itself. 101 years ago, the US economy entered a depression, which impacted the sales world dramatically. Salesperson turnover, primarily involuntary (aka, sales orgs purging their sales teams) went to 77% in 1921, and 85% in 1922. The scariest part is, the run up to the 1921 Depression looks EXACTLY like the run-up to today!

The only and primary difference between today and back then was the unemployment numbers. While the data is a bit sketchy, it appears as though unemployment went from 5.7% up to 23% back then. Today, it’s been hovering just below 4%, and there continues to be a labor shortage.

“Why? Why isn’t there an unemployment spike like there is historically after an inflation spike?”

They together explained that the labor participation rate is low. Older population retired early during the pandemic. Lots of on-demand work that doesn’t get accounted for in the numbers (i.e., Uber drivers and delivery drivers). On-demand work has changed the data. Couple that with the fact that US dollar money supply has gone up 40% in the last 2 ½ years.

A Counterintuitive Idea to Thrive: Extreme Firmographic Focus

While your inclination may be to cast a wider net of potential clients to call on, I encourage you to do the exact opposite. While you likely can help a broad range of companies, during the recession of 2008, we recognized one specific vertical where our messaging was resonating well, sales cycles were compact, deal sizes were larger, and our win rate was strong. We decided to focus the entire sales organization on it.

It wasn’t a mandate. They wanted to do it, because we enabled them to do it. For us, while we could call on any discrete manufacturing company, the industry we practiced extreme firmographic focus on was aerospace & defense (A&D) companies. We brought in a long-time expert on retainer to teach us about the industry, the players, the people, their priorities, how they are measured, and what they read. We had marketing focus on our current A&D accounts, bringing them in for lunch and learns, building and sharing case studies.

The next thing we knew, every rep was focusing on A&D. Our confidence grew. We could talk-the-talk we any A&D executive. We could actually make them smarter about their business, not ours, bringing in ideas from outside their internal bubble. That confidence became contagious. Prospects bought faster. Prospects bought more. We closed Boeing and Cessna and Gulfstream and Northrup Grumman.

The idea resonated so strongly, we kept it as our approach, expanding slowly to like industries – heavy manufacturing was next (Caterpillar and Deere), oil & gas (Halliburton and Schlumberger), and the next thing you knew, we were growing 400% year-over-year – and had a successful exit a couple of years later.

Regardless if you try this, there is so much advice available on how to thrive during a downturn. Read it. Take it. Use it. If you’re still messaging and selling like it’s October of 2021, buckle up. It’s October of 2022. I’m sure you’re already seeing it, but make sure you’re also doing something about it.

Two elements they shared with me as a bonus “heads up”. Politicians, regardless of the the party, will do two things before an election:

- They’ll hope you don’t understand the difference between “the deficit” and “the debt”. They’ll sell the uniformed on the idea that the government has brought down “the deficit” through curbing spending. That’s great…but doesn’t matter. “The debt” is the thing that will hurt us most long term. And, that’s gone from $20 Trillion up to $31 Trillion in just the past 5 years.

- They’ll hope you don’t understand that shrinking inflation doesn’t mean prices are going down, it just means they’re going up more slowly. And, through doing it via interest rates, investment will slow, which means layoffs, less investment, and a prolonged period of “stagflation“

0 Comments